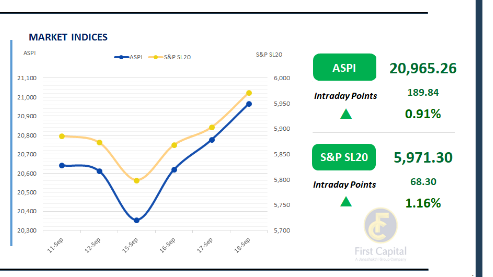

The Colombo Stock Exchange continued to thrive on the momentum built up from the previous session, as the ASPI closed with a gain of 190 points at 20,965. The index maintained an upward trajectory throughout the day, despite brief periods of volatility.

Key contributors to the upward movement included NTB, DFCC, JKH, CINS and MELS. Today's rally was led by the retail segment, followed by a reasonable level of HNW involvement as well.

Following the declaration of an LKR 5.0 dividend by FCT, investor attention shifted toward the stock, pushing its share price up by 30.2% and making it the top price gainer of the day.

Turnover for the day reached LKR 6.9Bn, reflecting a 9% decline compared to the monthly average that stands at around LKR 7.6Bn. In terms of sector-wise contribution to turnover, the Diversified Financials sector took the lead with a share of 24%, while the Banking, and Capital Goods sectors followed behind with a combined contribution of 32%. Foreign investors remained net sellers, recording a net outflow of LKR 481.2Mn.

Moderate levels of activity persist in the secondary market

The secondary market recorded moderate activity today; however, this had no impact on the overall yield curve, which remained stable. Among the trades executed, short-term maturities such as 15.10.2027 and 15.12.2027 traded within a range of 8.71% to 8.73%, while 01.05.2028 traded at 8.97%.

In the 2029 segment, 15.06.2029, 15.09.2029, and 15.12.2029 were traded within a range of 9.43% to 9.55%. The 15.05.2030 maturity saw trades at 9.58%, whereas 01.07.2030 traded at a higher yield of 9.72%.

Further along the curve, 15.03.2031 traded at 10.02%. In the 2032 segment, 01.10.2032 and 15.12.2032 traded between 10.40% and 10.45%. Finally, in the 2033 segment, 01.06.2033 and 01.11.2033 were traded at yields ranging from 10.70% to 10.75%. On the external front, the LKR appreciated marginally against the USD closing at LKR 302.0/USD compared to LKR 302.1/USD recorded the previous day. Overnight liquidity in the banking system contracted to LKR 133.5Bn from LKR 137.7Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..