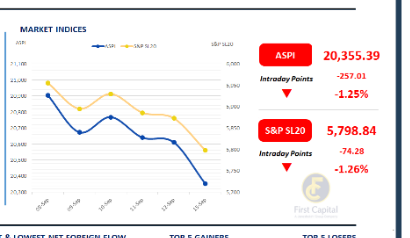

Echoing last week's sentiment, the Colombo Stock Exchange extended its negative streak, primarily due to profit-taking observed in Banking sector counters.

The ASPI closed in the red at 20,355, recording a loss of 257 points, witnessing the largest intraday decline since 23-Jun-2025.

COMB, SAMP, DFCC, HNB, and MELS were the top negative contributors to the index. Compared to the previous sessions, retail participation picked up, while HNW investor activity remained subdued.

Amidst this, daily turnover dropped to LKR 4.1Bn, reflecting a 48% decline from the monthly average of c.LKR 7.7Bn.

In terms of sector-wise contribution to turnover, the Banking sector took the lead with a share of 30% while Capital Goods sector and the Real Estate sector followed behind with a combined contribution of 28%. Foreign investors remained net sellers, recording a net outflow of LKR 80.5Mn.

Market sleeps as yields stay firm

Reflecting the subdued sentiment from the previous week, the secondary market remained quiet, with the yield curve unchanged.

Trading volumes remained very thin amid muted activity, while the 15.12.2029 maturity traded at a yield of 9.55%.

Additionally, during the week ending 12-Sep-2025, the AWPR declined by 3 basis points to 8.13%. In the forex market, the LKR appreciated slightly against the greenback, closing at LKR 301.8/USD, compared to the previously seen rate of LKR 301.9/USD.

Meanwhile, overnight liquidity in the banking system contracted to LKR 147.9Bn from the previously seen level of LKR 178.6Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..