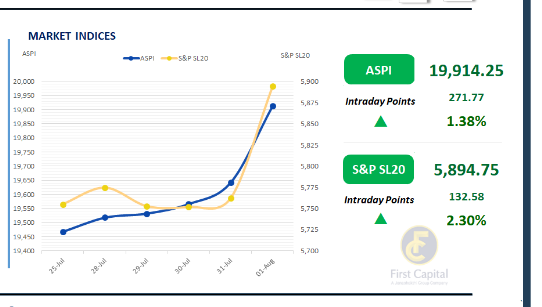

The Colombo Stock Exchange experienced a session driven by bullish sentiment and high levels of investor involvement, particularly from the retail segment, as the market continued to build on the positive momentum observed over the past few weeks

.

The ASPI gained 272 points, closing the week at 19,914. The index saw some volatility in the early hours, but once it found its footing, a steady upward trend was observed. Investor sentiment was further strengthened by the favorable verdict on U.S. tariffs, which were set at 20% for Sri Lanka, and by strong earnings reports as interim financial results began to be released.

Key positive contributors for the day were HNB, JKH, COMB, DFCC and NDB. Daily turnover amounted to LKR 7.4Bn, which is broadly in line with the monthly average that stands at LKR 7.2Bn. The Banking sector dominated turnover, contributing 30%, followed by the Materials and Capital Goods sectors with a joint contribution of 28%. Foreign investors remained net sellers with a net outflow of LKR 144.0Mn.

Yields shift slightly as secondary market rallies on US tariff cut

Today, the secondary market saw heightened investor interest, marked by elevated trading volumes and robust activity, following the further reduction in US tariff rates on Sri Lankan imports to 20%.

This renewed interest led to a modest shift in the yield curve, reflecting strong buying momentum across maturities. At the short end of the curve, bonds maturing on 01.05.2028, 15.10.2028, and 15.12.2028 saw yields ranging from 8.72% to 8.95%. For 2029 maturities, including 15.09.2029, 15.10.2029, and 15.12.2029, yields were observed between 9.35% and 9.45%.

In the belly of the curve, 15.05.2030 and 01.07.2030 were traded with yields between 9.50% and 9.65%. Further along the curve, 15.03.2031 traded between 9.90% to 9.95%, while 15.12.2032 saw yields between 10.25% and 10.30%.

Meanwhile, both 01.06.2033 and 01.11.2033 maturities were exchanged at 10.65%. Finally, the 15.09.2034 maturity changed hands at 10.80%. In the forex market, the LKR appreciated against the greenback, closing at LKR 302.19/USD, compared to the previously seen rate of LKR 302.21/USD. Meanwhile, overnight liquidity in the banking system contracted to LKR 76.3Bn from the previously seen level of LKR 114.1Bn

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..