The Colombo Stock Exchange witnessed increased volatility as investors eagerly await the verdict on U.S. reciprocal tariffs, set to be announced tomorrow.

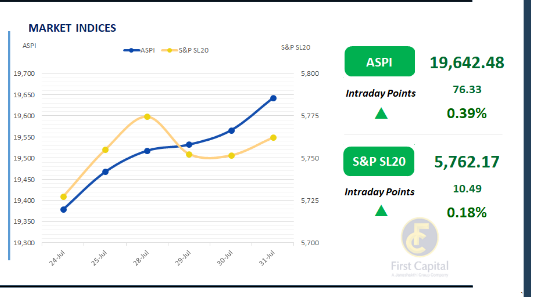

The ASPI registered a 76-point gain to close at 19,642. The index experienced high volatility in the early hours, briefly dipping into negative territory as well, after which a gradual rebound was staged lifting the index higher by the close. Key positive contributors for the day were HAYL, DFCC, BIL, NDB and COCR.

Today's session was supported primarily by HNW investors followed by reasonable involvement from the retail segment as well. Positive sentiment prevailed towards mid cap banks such as UBC, PABC, NDB and DFCC as quarterly results begin to roll in.

Investors also diverted notable focus towards selective Plantation sector counters and Materials sector companies such as ACL, in the wake of reduced copper prices. Daily turnover amounted to LKR 5.7Bn, a 22% decrease compared to the monthly average of LKR 7.2Bn.

The Banking sector dominated turnover, contributing 27%, followed by the Capital Goods sector at 24% and the Food, Beverage and Tobacco sector at 16%. Foreign investors remained net sellers with a net outflow of LKR 134.0Mn.

Buying interest returns, long tenors see foreign demand

Today, the secondary market broke from the lethargy that had persisted throughout the week. Market participants displayed buying interest, with the long end of the curve attracting foreign interest.

The session was characterized by elevated volumes, despite a relatively moderate number of trades. At the short end of the yield curve, 15.10.2028 traded at 9.00%. In terms of 2029 maturities, 15.10.2029 and 15.12.2029 traded at 9.46% and 9.52% respectively.

Moving ahead, 15.03.2031 maturity was seen changing hands at 10.06%. Finally, both 15.12.2032 and 01.11.2033 attracted significant foreign buying interest with the 2032 maturity trading between 10.45% to 10.35% and the 2033 maturity trading between 10.82% to 10.77%.

In the forex market, the LKR depreciated against the greenback, closing at LKR 302.20/USD, compared to the previously seen rate of LKR 302.04/USD. Meanwhile, overnight liquidity in the banking system expanded to LKR 114.1Bn from the previously seen level of LKR 106.2Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..