The market experienced significant volatility today amidst reasonably high investor activity which resulted in yet another session wrapping up in positive territory.

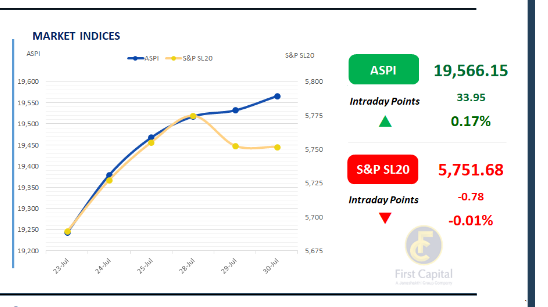

The ASPI registered a 34-point gain to close at 19,566. The index surged at the open and peaked by late morning, after which selling pressure resulted in a continuous decline before staging a minor comeback that lifted it higher toward the session's close.

Key contributors to the index's gain included MELS, SEYB, CTC, ACL, and SAMP. Both retail and HNW investors remained active as optimism from previous sessions lingered. Daily turnover amounted to LKR 5.3Bn, a 27% decrease compared to the monthly average of LKR 7.3Bn.

The Capital Goods sector dominated turnover, contributing 28%, followed by the Banking and Diversified Financials sectors, which collectively accounted for 32%. Foreign investors remained net sellers with a net outflow of LKR 36.2Mn.

Muted activity leaves yield curve steady in secondary market

The secondary market experienced another quiet trading day, leaving the yield curve unchanged due to limited activity. Trading volumes remained light, with only a few maturities recording any movement.

At the short end of the curve, the 01.07.2028 and 15.10.2028 bonds were traded within a range of 8.95% to 9.01%. Further along the curve, the 15.12.2029 maturity saw trades at a yield of 9.55%.

The Central Bank concluded its weekly Treasury Bill auction today, raising LKR 66.1Bn, 28.5% below the initially offered LKR 92.5Bn, with yields remaining unchanged across all maturities.

The 3M bill generated LKR 31.3Bn, with its weighted average yield remaining unchanged at 7.62%. The 6M bill raised LKR 17.6Bn, with yield remaining unchanged at 7.91%.

Meanwhile, the 12M bill drew LKR 17.3Bn, with yield remaining unchanged at 8.03%. In the forex market, the LKR depreciated against the greenback, closing at LKR 302.04/USD, compared to the previously seen rate of LKR 301.95/USD.

Meanwhile, overnight liquidity in the banking system expanded to LKR 106.2Bn from the previously seen level of LKR 90.2Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..