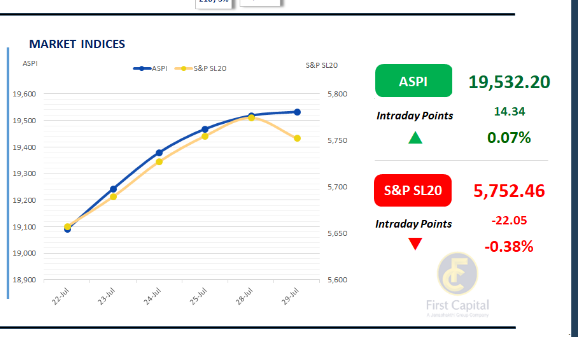

Investor optimism carried through into today's session, as the Colombo Stock Exchange witnessed yet another day of positive sentiment. The ASPI closed in the green, having gained 14 points to end at 19,532

.

The index witnessed an initial uptick followed by a sharp dip as investors sought after booking profits, before regaining strength, supported by gains in counters such as ACL, MELS, HAYL, CFIN and CARG.

Both retail and HNW investors remained active in the market, with heightened interest observed particularly in HNB.X shares, while daily turnover reached LKR 7.6Bn, reflecting a 6% increase compared to the monthly average of LKR 7.2Bn

.

The Banking sector dominated activity by contributing 38% of the turnover, followed by the Capital Goods sector with 26% and the Materials sector at 8%. Foreign investors turned net sellers with a net outflow of LKR 114.2Mn.

BOND MARKET

CBSL accepts selective bids at bond auction

The secondary bond market endured another subdued trading session today, resulting in a largely unchanged yield curve as activity remained minimal.

Trading volumes were notably thin, with only a handful of maturities seeing movement. At the short end of the curve, the 01.05.2028 maturity traded at 8.90%, while the 15.10.2028 and 15.12.2028 maturities changed hands between 9.02% to 9.05%.

Meanwhile, the Central Bank of Sri Lanka concluded today's scheduled treasury bond auction, raising only a portion of the targeted LKR 122.0Bn. The initial plan aimed to raise LKR 90.0Bn through a 2030 maturity bond carrying a 9.75% coupon, and LKR 32.0Bn via a 2037 maturity bond with a 10.75% coupon.

However, only LKR 50.2Bn was accepted for the 2030 bond, while the 2037 bond saw acceptances totaling LKR 20.9Bn. The weighted average yields were 9.77% for the 2030 bond and 11.08% for the 2037 bond. In the forex market, the LKR depreciated against the greenback, closing at LKR 301.95/USD, compared to the previously seen rate of LKR 301.87/USD.

Meanwhile, overnight liquidity in the banking system contracted to LKR 90.2Bn from the previously seen level of LKR 102.9Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..