The Bourse opened the week on a strong footing, continuing the positive momentum from the previous sessions as investor confidence was reflected through active participation.

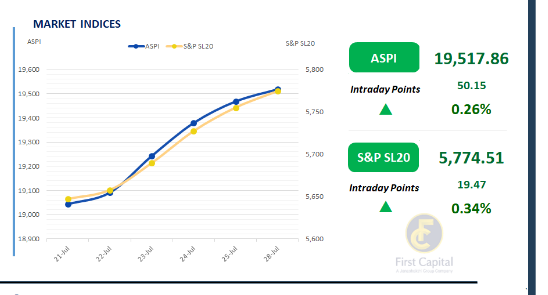

The ASPI advanced by 50 points to close at 19,518. The index climbed steadily at the open, peaking by late morning, before moderate selling pressure led to a slight pullback.

Despite this, the market ended in positive territory, aided by positive contributions from RCL, MELS, HHL, LFIN and CTHR. HNW investor participation remained strong amidst multiple crossings, closely followed by robust retail activity.

Daily turnover reached LKR 6.2Bn, marking a 14% decline compared to the monthly average of LKR 7.1Bn. The Capital Goods sector led in terms of turnover, accounting for 30%, followed by the Banking, and Diversified Financials sectors, which collectively accounted for 33%. Foreign investors remained net buyers with a net inflow of LKR 30.2Mn.

Thin trading keeps secondary market yield curve stable

The secondary market yield curve saw very limited activity with thin trading volumes, resulting in the yield curve remaining broadly unchanged.

Among the few maturities traded, the 15.09.2027 and 01.09.2028 bonds were exchanged at yields of 8.50% and 9.04%, respectively. Moving further along the yield curve, the 15.06.2029, 15.09.2029, 15.10.2029, and 15.12.2029 maturities traded at yields of 9.47%, 9.49%, 9.50%, and 9.55%, respectively.

Meanwhile, the Central Bank of Sri Lanka announced a bond auction totaling LKR 122.0Bn, scheduled for 29th July 2025. The auction aims to raise LKR 90.0Bn from the 2030 maturity and LKR 32.0Bn from the 2037 maturity.

In the forex market, the LKR depreciated marginally against the greenback, closing at LKR 301.9/USD, compared to the previously seen rate of LKR 301.8/USD. Meanwhile, overnight liquidity in the banking system expanded to LKR 102.9Bn from the previously seen level of LKR 93.9Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..