The Colombo Bourse opened lower with a sharp early drop and showcased a partial recovery during the second half to partially offset the losses made during first half of the day.

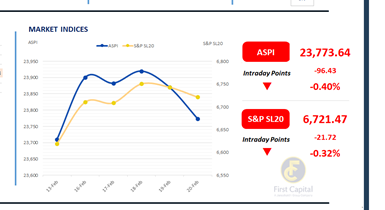

Both the ASPI and S&P SL20 ended slightly down following the tension building up in the middle east and the release of banking sector results for the last quarter.

ASPI is down by 96 points, closing at 23,774, while the S&P SL20 has slipped down by 22 points to settle at 6,721. Leading negative contributors to the ASPI were COMB, CTHR, MELS, BUKI and JKH. HNW and retail investor participation were subdued, resulting a lower turnover level of LKR 3.9Bn, marking a decrease of 41.5% over the monthly average of LKR 6.6Bn.

Banking sector led the daily turnover with a share of 23%, followed by the Insurance, and Capital Goods sectors collectively contributing 35%. Foreign investors turned net sellers, posting a net outflow of LKR 11.3Mn.

BOND MARKET

Subdued trading activity keeps yield curve unchanged

Market activity remained relatively subdued today, with thin trading volumes leaving the overall yield curve largely unchanged.

As it was the final trading day of the week and ahead of next week’s scheduled bond auction, market participation was minimal.

At the short end of the curve, the 15.05.2028 maturity traded at 9.05%. In the 2029 segment, the 15.06.2029 and 15.09.2029 maturities traded at 9.40% and 9.49%, respectively.

The 15.05.2031 maturity was exchanged at 9.90%. Further along the curve, the 01.10.2032 traded at 10.23%, followed by 01.06.2033 at 10.53% and 15.06.2034 at 10.70%.

Finally, at the long end, the 01.07.2037 maturity traded at 10.92%. On the external front, the LKR appreciated against the USD, closing at LKR 309.31/USD compared to LKR 309.38/USD recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..