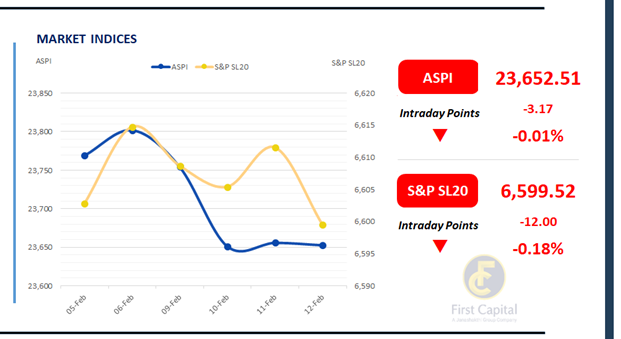

The Colombo Bourse showed a subdued and slightly negative performance during the session, with both indices trading in the red.

Despite the early upward momentum both the indices marginally dropped as the ASPI declined by 3 points to 23,653, while the S&P SL20 dropped by 12 points to 6,600.

Top negative contributors to the ASPI were RICH, CFIN, JKH, RIL and AEL. Share prices of 125 companies declined during the session, while only 106 recorded positive contributions. HNW participation was limited and retail investors’ participation also remained subdued.

Daily turnover stood at LKR 4.8Bn, marking a decrease of 29.8% over the monthly average of LKR 6.9Bn. Banking sector led the daily turnover with a share of 30%, followed by the Food Beverage & Tobacco, and Capital Goods sectors collectively contributing 31%. Foreign investors remained net sellers, posting a net outflow of LKR 42.8Mn.

BOND MARKET

Yield curve eases as T-bond auction concludes

The secondary bond market yields declined across the curve, while buying interest persisted amidst large trading volumes. The PDMO concluded the T-bond auction, with the offers fully subscribed.

Over 2029 segment, 15.06.2029, 15.09.2029, 15.10.2029 and 15.12.2029 maturities traded in the range of 9.34%-9.45%. Moving ahead, 01.03.2030, 15.05.2030 and 01.07.2030 traded within the band of 9.55%-9.50%.

Further towards mid-term maturities, 15.03.2031, 01.10.2032, 01.06.2033 and 15.09.2034 changed hands at 9.70%, 10.10%, 10.38% and 10.60% respectively. Around the long tenor, 15.06.2035, 01.07.2037 and 15.08.2039 traded at 10.73%, 10.85% and 10.90% respectively.

At the T-bond auction, PDMO accepted its initial offer in full, totaling to LKR 51.0Bn. Acceptances on 01.03.2030 and 15.08.2036 maturities were LKR 21.0Bn and LKR 30.0Bn while the weighted average yields stood at 9.52% and 10.73% respectively.

On the external front, the LKR appreciated against the USD, closing at LKR 309.39/USD compared to LKR 309.46/USD recorded the previous day. Overnight liquidity in the banking system marginally expanded to LKR 296.71Bn from LKR 296.45Bn recorded previously.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..