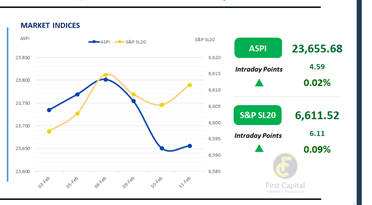

The Colombo Bourse showed a mildly positive but cautious tone during the session. Both indices experienced early volatility with a mid-morning dip, followed by a gradual recovery and sideways movement into the close.

ASPI edged up 5 points to 23,656, while the S&P SL20 gained 6 points to 6,612. Top positive contributors to the ASPI were NHL, CFIN, CARG, JKH and LLUB. Share prices of 125 companies declined during the session, while only 98 recorded positive contributions.

HNW participation was limited, and retail investors’ participation also remained subdued, leading to low turnover. Daily turnover stood at LKR 3.4Bn, marking a decrease of 52.6% over the monthly average of LKR 7.1Bn.

Capital Goods sector led the daily turnover with a share of 20%, followed by the Food Beverage & Tobacco, and Diversified Financials sectors collectively contributing 32%. Foreign investors remained net sellers, posting a net outflow of LKR 64.0Mn.

BOND MARKET

Short end of the yield curve sees buying interest

Public Debt Management Office concluded its weekly T-Bill auction where LKR 90.0Bn was raised, accepting the fully offered amount. The weighted average yields inched down across all tenures with that of the 3M Bill inching down by 8bps to settle at 7.72% while that of the 6M and 12M tenures dipped by 10bps and 2bps, settling at 8.07% and 8.31% respectively.

The secondary market yield curve witnessed buying interest in short tenors, albeit with moderate volumes and limited overall activity. Yields edged down across the yield curve compared to the previous week.

Amongst the traded maturities, the 15.10.2028 bond traded at 9.05%, while 15.06.2029, 15.07.2029, 15.10.2029, and 15.12.2029 traded in the range of 9.35%–9.50%. Further along the curve, 01.03.2030, 01.07.2030, and 15.10.2030 traded between 9.60%–9.65%.

The 15.03.2031 and 15.12.2032 maturities were quoted at 9.80% and 10.15%, respectively. Additionally, 01.06.2033 and 01.11.2033 traded around 10.45%–10.50%, while 15.06.2034 maturity changed hands at the rate of 10.65%. On the external front, the LKR depreciated against the USD, closing at LKR 309.46/USD compared to LKR 309.45/USD recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..