Colombo Bourse saw a modest decline today, as indices trended downward early on before stabilizing, with blue-chip stocks experiencing slightly more selling pressure.

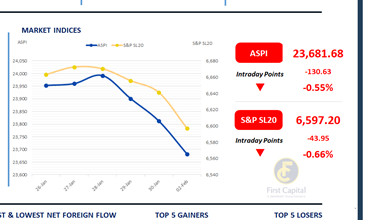

ASPI declined by 131 points to close at 23,682, while S&P SL20 dropped by 44 points to close at 6,597. Top negative contributors to the ASPI were CINS, DOCK, MELS, COMB and JKH. HNW and retail participation remained average.

Daily turnover stood at LKR 5.2Bn, marking a decrease of 24.1% over the monthly average of LKR 6.8Bn. Capital Goods sector led the daily turnover with a share of 40%, followed by the Diversified Financials, and Insurance sectors collectively contributing 27%. Foreign investors continued their selling streak for the 11th consecutive day, recording a net outflow of LKR 371.0Mn.

BOND MARKET

Secondary market sees mild buying interest in short-end maturities

The week started with slight buying interest towards the short-tenor maturities in the secondary market, although it witnessed thin volumes and limited activities.

Over 2028 segment, the 15.03.2028, 01.05.2028, 01.09.2028, 15.10.2028 and 15.12.2028 traded in the range of 9.03%-9.20%. Also, the 15.06.2029, 15.09.2029, 15.10.2029 and 15.12.2029 changed hands between 9.53% and 9.60%.

Moreover, the CBSL announced that the Colombo Consumer Price Index based headline inflation accelerated to 2.3% in January 2026, compared to 2.1% recorded in December 2025.

Food inflation rose to 3.3% from 3.0% in December 2025, while Non-Food inflation remained flat at 1.8%. However, core inflation decelerated to 2.3% in January 2026, compared to 2.7% in December 2025.

On the external front, the LKR appreciated against the USD, closing at LKR 309.25/USD compared to LKR 309.50/USD seen previously.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..