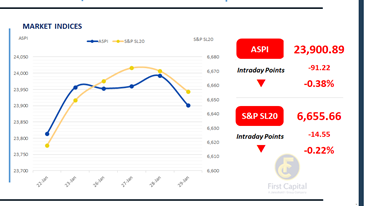

The market closed lower as profit-taking and weakness in blue-chip counters dragged both the ASPI and S&P SL20 into negative territory, reflecting cautious to mildly bearish investor sentiment with limited buying interest.

ASPI declined by 91 points to close at 23,901, while S&P SL20 dropped by 15 points to close at 6,656. Top negative contributors to the ASPI were SFCL, CTC, JKH, CARS and CTHR. HNW and retail investors’ participation remained at an average level. Daily turnover stood at LKR 6.9Bn, marking an increase of 6.1% over the monthly average of LKR 6.5Bn.

Capital Goods sector led the daily turnover with a share of 22%, followed by the Real Estate Management & Development, and Insurance sectors collectively contributing 31%. Foreign investors remained net sellers, posting a net outflow of LKR 20.9Mn.

BOND MARKET

T-bond auction sparks long-end demand

The secondary market registered high trading volumes, with buying interest emerging at the long-end, post T-bond auction. Long-end yields slightly edged down, following the T-bond auction.

Prior to the T-bond auction, buying interest was observed towards short-end maturities, where 15.02.2028, 15.03.2028 and 09.05.2028 traded in the range of 9.10%-9.00%. Over 2029 segment, both 15.10.2029 and 15.12.2029 traded at 9.60%. Post T-bond auction, buying sentiment shifted the gear towards the long-end.

Among the long-term tenors that were traded, 01.06.2033 changed hands at 10.65%. Both 15.06.2034 and 15.06.2035 traded at 10.85%, while 01.07.2037 traded at 11.00%. At the T-bond auction held today, PDMO raised a total of LKR 179.1Bn against an offer of LKR 205.0Bn.

Both 01.03.2030 and 15.06.2034 maturities were accepted in full, with LKR 60.0Bn and LKR 80.0Bn respectively. However, only a portion of 01.07.2037 tenor was accepted at LKR 39.1Bn, against the offer of LKR 65.0Bn.

Weighted average yields for the three maturities stood at 9.72%, 10.92% and 11.08% respectively. On the external front, the LKR depreciated against the USD, closing at LKR 309.65/USD compared to LKR 309.61/USD seen previously. Overnight liquidity in the banking system contracted to LKR 194.26Bn from LKR 211.53Bn recorded previously.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..