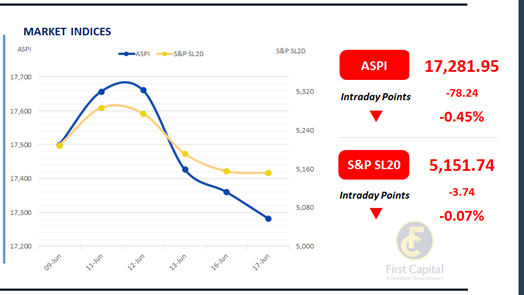

The Colombo Stock Exchange experienced a day of selling pressure and rattled investor behavior in the face of global geo-political uncertainty.

The ASPI kicked off the day with some decent gains and managed to hold steady for most of the morning, but towards the end of the session, it started to come under some selling pressure, which dragged it down sharply, ultimately closing at 17,281 with a 78 point drop.

NDB, LOLC, DFCC, BIL and NTB were the key counters that exerted downward pressure on the index. Retail investors expressed moderate levels of activity whereas HNW investors engaged in active trading with primary interest towards Banking sector stocks and blue-chips such as HAYL and JKH.

Turnover reached LKR 6.8Bn, marking a 35% increase relative to the monthly average of LKR 5.1Bn. The Capital Goods sector led today's turnover, contributing 34%, followed by the Banking, and Diversified Financials sectors, jointly accounting for 40%. Foreign investors remained net sellers, with a net outflow of LKR 115.7Mn.

BOND MARKET

War clouds continue but yield curve shows no shift

Increasing concerns over looming global uncertainty have left secondary bond market participants cautious, with investors adopting a wait-and-see approach.

As a result, the yield curve held its breath, witnessing low volumes and minimal market activity. However, amongst the traded maturities 01.05.2028, 01.07.2028, 15.10.2028, 15.12.2028, 15.09.2029 and 15.12.2032 changed hands at the rates of 8.88%, 8.90%, 8.92%, 8.95%, 9.48% and 10.32% respectively.

In the forex market, the LKR depreciated against the greenback, closing at LKR 300.0/USD, compared to the previously seen rate of 299.4/USD. Meanwhile, overnight liquidity in the banking system contracted to LKR 122.9Bn from LKR 131.9Bn in the previous session. On a positive note, recently released data from the Census and Statistics Department shows that GDP grew by 4.8%YoY in 1Q2025.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..