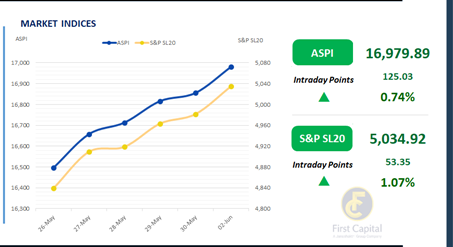

The Colombo Stock Exchange commenced the week on a positive note, with the ASPI gaining 125 points to close at 16,980. The market opened on an upbeat tone and maintained its upward momentum throughout the session, experiencing minor fluctuations in the latter part before closing firmly in positive territory.

The rally was primarily driven by strong performances in key Banking sector stocks, including SAMP, DFCC, NDB, and HNB, along with support from AEL. Investor sentiment remained buoyant, with active participation from retail investors.

Meanwhile, interest from HNW investors was observed in counters such as AFS, JKH, and SDF. Total market turnover stood at LKR 5.9Bn, representing a 42% increase compared to the monthly average of LKR 4.1Bn.

The Capital Goods sector led the day's turnover, accounting for 30% of the total, followed by the Diversified Financials, and Banking sectors, which together contributed 37%. Foreign investors continued to adopt a cautious stance, recording a net outflow of LKR 2.7Bn.

Bond Market: Mixed interest marks the start of trading week

The week kicked off with a wave of mixed sentiment sweeping through the secondary bond market. Investor appetite leaned toward longer-tenor maturities, reflecting a more defined buying interest in that segment.

In contrast, the short- to mid-tenor segment saw mixed interest. Overall, trading activity remained moderate, signaling a measured start to the week.

On the short end of the curve, 01.05.2028, 01.07.2028 and 15.10.2025 traded within the 8.85% to 9.00% range. In terms of 2029 maturities, 15.06.2029, 15.09.2029 and 15.12.2029 changed hands between 9.50% to 9.63%.

Moving ahead on the yield curve, 15.12.2032 traded between 10.20%-10.30%. Finally, 15.09.2034 and 15.03.2035 were seen trading within the 10.45% to 10.52% range.

In the forex market, the LKR appreciated marginally against the greenback, closing at LKR 299.42/USD, compared to the previously seen rate of 299.44/USD. Meanwhile, overnight liquidity in the banking system contracted to LKR 149.9Bn from LKR 203.8Bn in the previous session.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..