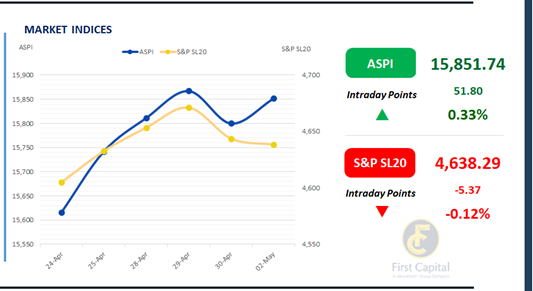

The month commenced on a positive note with the Bourse experiencing a day of positive sentiment and increased activity. The ASPI closed 52 points up at 15,852, reflecting a 0.33% surge.

PABC, CTHR, DFCC, MELS and NTB emerged as the top positive contributors to the index. Retail investors showed a modest uptick in activity compared to the previous session, while HNW participation saw a notable surge, significantly boosting today’s turnover — driven primarily by crossings in CTHR and CARG, which together accounted for 68.4% of the total turnover.

The slight moderation in March's Construction PMI still signaled growth, which aligned with renewed investor interest in specific counters in the sector such as AEL, JAT, and ACL.

Furthermore, the Banking sector saw positive sentiment, with PABC leading the way following stellar quarterly results. The turnover surged to LKR 5.9Bn, reflecting a 132.3% increase from the monthly average of LKR 2.5Bn.

The Food Retailing sector led today’s turnover with a 68% share, followed by the Banking and Food, Beverage & Tobacco sectors jointly accounting for 16%. Foreign investors remained net sellers, with a net outflow of LKR 87.1Mn.

Renewed buying interest drives bond yields lower across the curve

Pivoting from the subdued sentiment seen in the previous week, the secondary bond market began the month with renewed buying interest, leading to moderate trading volumes. Investor sentiment at the short end of the yield curve remained mixed.

Overall, yields trended downward across the yield curve. Amongst the traded maturities, 15.02.2028 and 15.03.2028 traded between the rates of 9.90% to 9.85% whilst 15.10.2028 traded at the rate of 9.95%.

Meanwhile, 15.06.2029, 15.09.2029 and 15.12.2029 traded at the rates of 10.38% to 10.25%. Additionally, 15.03.2031 traded between the rates of 10.90% to 10.80%.

Meanwhile, the Department of Census and Statistics released the CCPI inflation data for Apr-25, showing an uptick to -2.0%, compared to -2.6% in Mar-25.

This movement remains well aligned with CBSL’s inflation target of 5.0% medium to long term. In the foreign exchange market, the LKR continued its modest appreciation against the USD for the 3rd consecutive day, closing at LKR 299.57/USD, compared to the previous day's rate of 299.62/USD.

Meanwhile, overnight liquidity in the banking system contracted to LKR 163.3Bn from LKR 168.9Bn in the previous session.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..