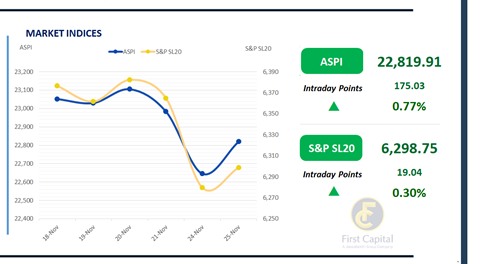

The Colombo Bourse reversed the bearish sentiment which persisted throughout the last few sessions and turned into positive territory today. The ASPI closed at 22,820, gaining 175 points.

Although there was some volatility, the index showed a steady upward movement. Improved investor sentiment on Banking and Diversified Financials sector counters, as well as conglomerates, raised the index up.

Moreover, S&PSL20 index climbed up 19 points to 6,299. CINS, NDB, MELS, BIL and SUN emerged as the top positive contributors to the index. Although retail participation was moderate, High net worth investors were highly active today.

Daily turnover stood at around 4.1Bn, reflecting a 29% decline compared to the monthly average of LKR 5.7Bn. On a sectoral basis, the Banking sector dominated activity, accounting for 31% of total turnover, followed by the Capital Goods and Diversified Financials sectors, which collectively contributed 33%.

Foreign investors turned net sellers recording a net outflow of LKR 213.2Mn.

BOND MARKET

Investors await policy decision, selling stance persists

The secondary bond market witnessed some selling pressure yesterday ahead of the monetary policy decision set to be announced early tomorrow.

However, both activity and volumes remained limited. At the short end of the curve 15.02.2028 and 15.03.2028 traded at 9.05% while 15.12.2028 traded higher at 9.15%.

Moving ahead, 15.12.2029 traded at a rate of 9.54%. Finally, 15.09.2034 and 15.06.2035 were seen changing hands 10.60% and 10.70% respectively.

On the external front, the LKR slightly appreciated against the USD, closing at LKR 307.86/USD compared to LKR 307.98/USD seen previously.

Overnight liquidity in the banking system expanded to LKR 79.3Bn from LKR 58.5Bn recorded on the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..